Bucks County Real Estate: The Great Price Correction of 2025?

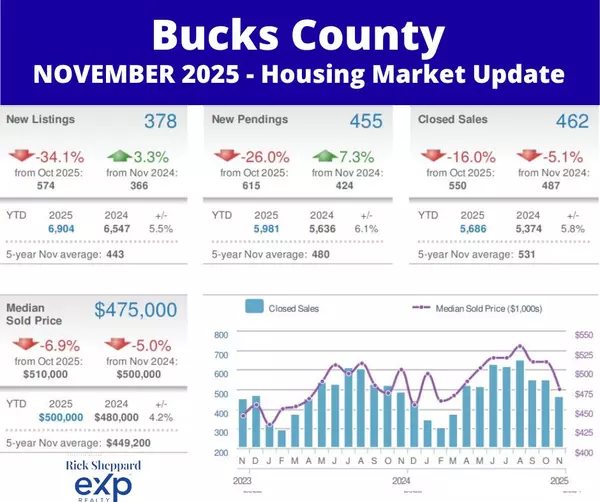

Well, if you’ve been waiting for a plot twist in the suburban Philadelphia housing saga, Bucks County just delivered. The November 2025 housing report is in, and it’s showing something we haven’t seen in a while: a significant price drop. Is this the beginning of a buyer’s revolution, or just a momentary blip? Let’s get into it.

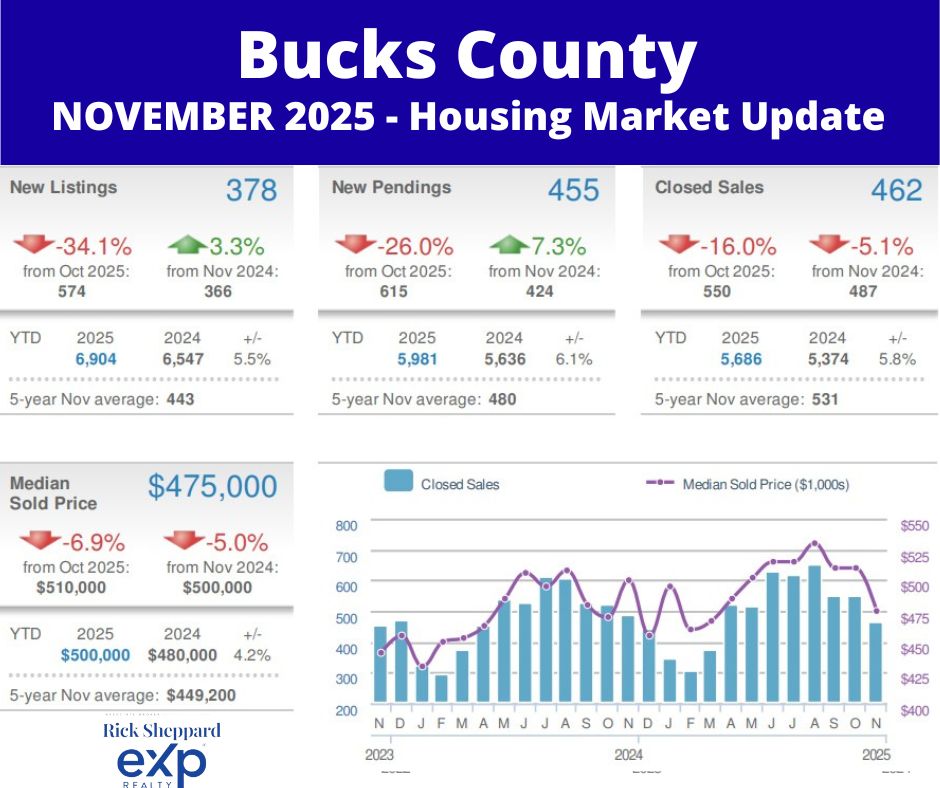

November by the Numbers

First, the data. The table below shows a market in transition, with some familiar seasonal slowdowns but one very unfamiliar trend in the price column.

|

Metric

|

November 2025

|

Change from Oct 2025

|

Change from Nov 2024

|

|

New Listings

|

378

|

-34.1%

|

+3.3%

|

|

New Pendings

|

455

|

-26.0%

|

+7.3%

|

|

Closed Sales

|

462

|

-16.0%

|

-5.1%

|

|

Median Sold Price

|

$475,000

|

-6.9%

|

-5.0%

|

|

Active Listings

|

711

|

-12.3%

|

+4.2%

|

|

Average Days on Market

|

26

|

-13.3%

|

+4.0%

|

Unpacking the Bucks County Anomaly

The Elephant in the Room: Prices Are Down

Let’s not bury the lede. The median sold price in Bucks County fell to $475,000. That’s a 5.0% drop from this time last year and a hefty 6.9% decrease from just last month. In a regional market where prices have been relentlessly climbing, this is a major development. While the year-to-date median price is still up 4.2% over 2024, this sharp November downturn suggests that buyer affordability has finally hit a wall. Sellers who have been holding out for peak-of-the-market prices are now having to face a new reality.

Activity: A Tale of Two Trends

The market activity numbers are a mixed bag. As expected for this time of year, new listings, new pendings, and closed sales all dropped significantly from October. However, when we look at the year-over-year numbers, a different story emerges. New listings were actually up 3.3% and new pending sales were up a strong 7.3% compared to November 2024. This indicates that despite the price correction, there are still more buyers and sellers entering the market than last year. The lower prices may be enticing some buyers who were previously sidelined.

Inventory and Pace: A Glimmer of Normalcy

For weary buyers, there are a few other positive signs. Active listings are up 4.2% from last year, offering a little more choice. And while homes are still selling quickly at an average of 26 days, the sold-to-list price ratio of 98.9% suggests that the days of routine, massive bidding wars may be fading. Sellers are getting close to their asking price, but not necessarily tens of thousands over it.

The Mortgage Factor

With mortgage rates currently hovering around 6.15% APR , the pressure on prices is understandable. Even with this slight dip from recent highs, the cost of borrowing remains a significant hurdle for many. The price correction in Bucks County is a direct reflection of the market adjusting to this new financial landscape. What buyers can afford is now dictating price, not just what sellers want.

The Final Word

Bucks County is currently the most interesting character in our local real estate drama. It’s the first of the major Philly suburbs to show a significant price correction, signaling a potential shift towards a more balanced market. This isn’t a crash, but it is a clear and necessary adjustment.

For sellers, it means the golden ticket days are over; pricing strategically is now the name of the game. For buyers, it’s a welcome sign that sanity might be returning to the market. Keep your eyes on Bucks County, folks—it might just be showing us the future.

Want to know what's happening in your specific neighborhood? Request a custom market analysis tailored to your area – complete with hyperlocal pricing trends, inventory levels, and comparable sales data that matter most to your home buying or selling decision.

References

Categories

Recent Posts

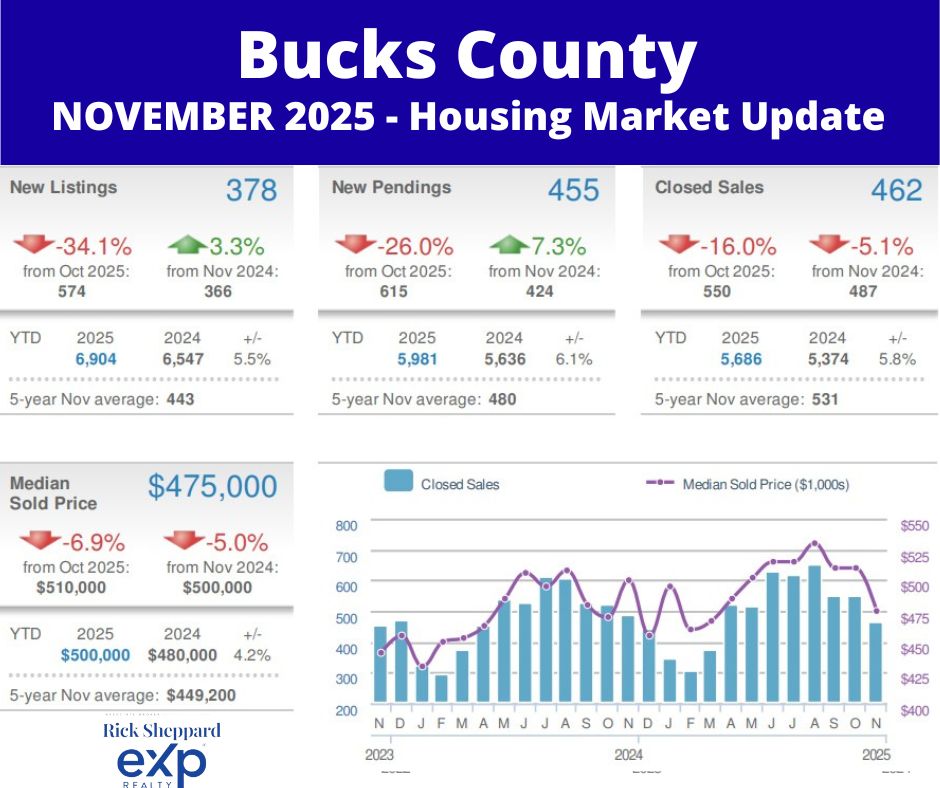

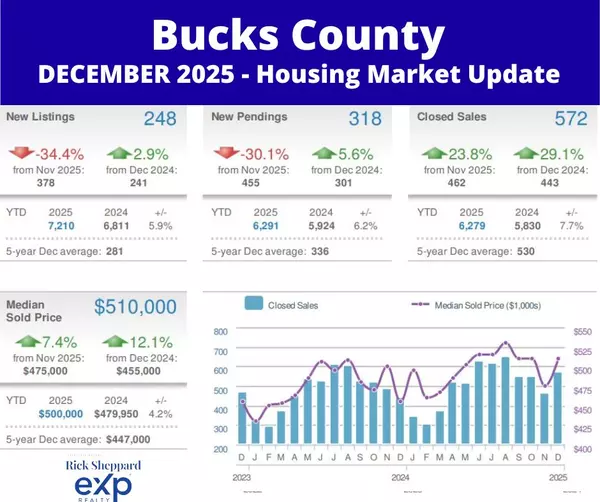

Bucks County Housing Market: Ending 2025 with a Bang!

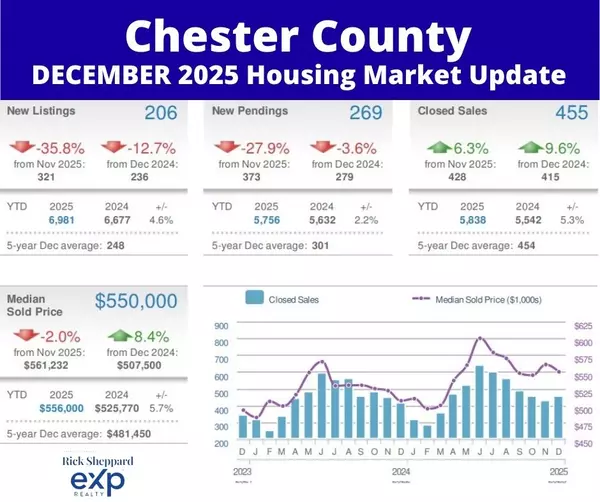

Chester County Housing Market: Ending 2025 on a High Note!

Montgomery County Housing Market: Wrapping Up 2025 with a Twist!

Bucks County Real Estate: The Great Price Correction of 2025?

Chester County Real Estate: The Market That Refuses to Chill

Montgomery County Housing Market: Is Winter Hibernation Here Already?

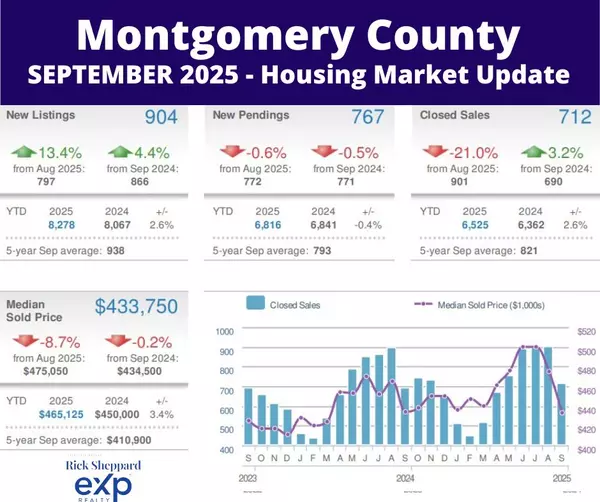

Montgomery County Housing Market Update - September 2025

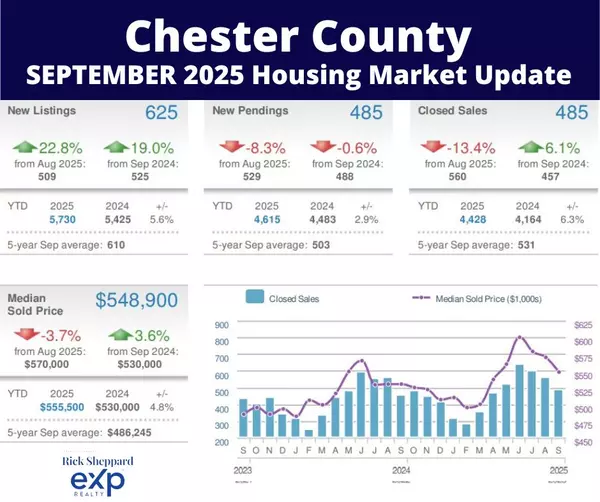

Chester County Housing Market Update - September 2025

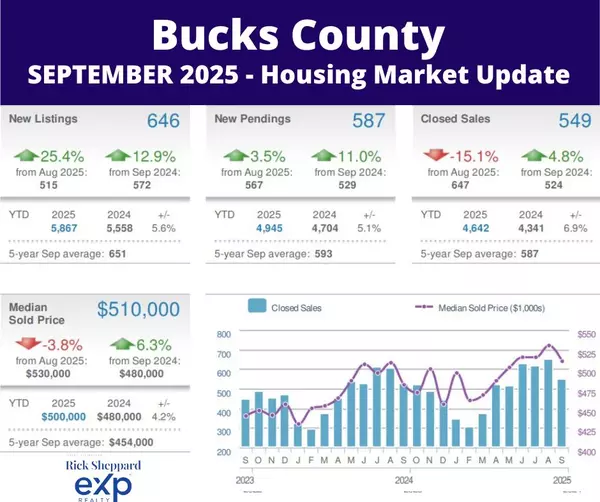

Bucks County Housing Market Update - September 2025

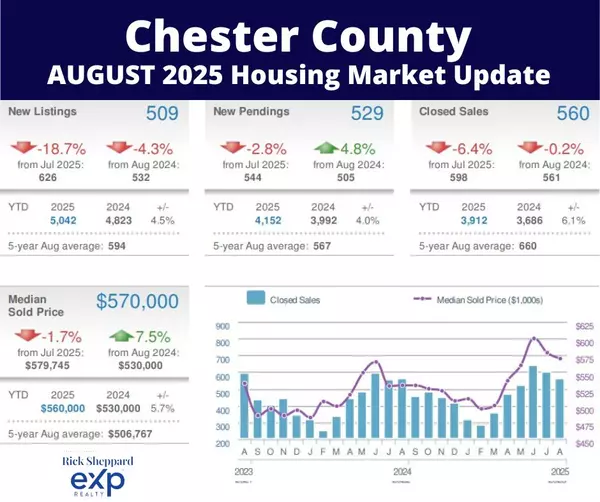

Chester County Housing Market Update - August 2025